Datamaran Launches Double Materiality Assessment Solution

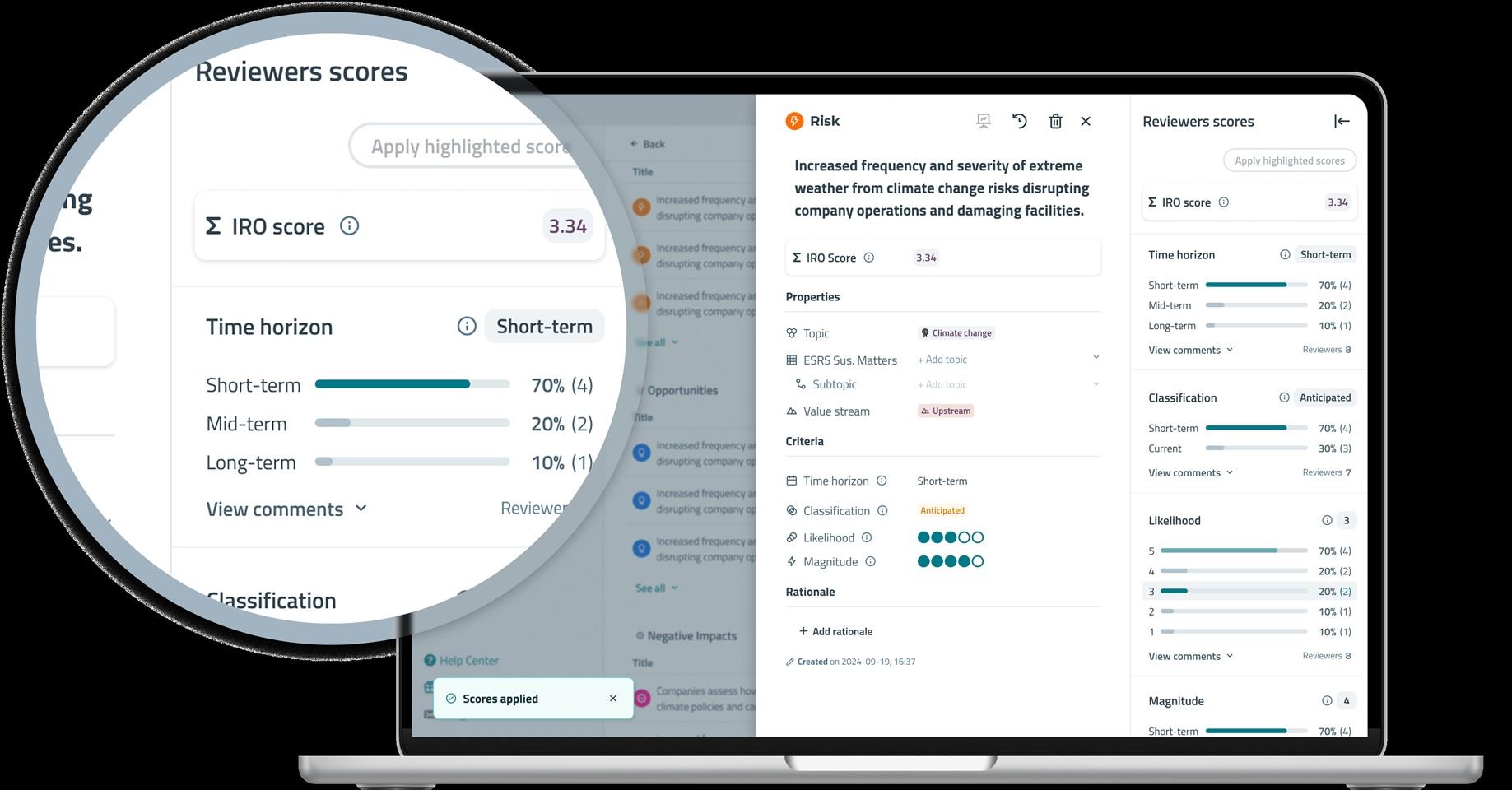

ESG-focused software analytics platform provider Datamaran announced the launch of DMA Evaluate, a new tool aimed at enabling companies to continuously update their double materiality assessment to ensure ongoing regulatory compliance and risk management.

“Double materiality” is one of the hallmark new approaches introduced by the EU’s Corporate Sustainability Reporting Directive (CSRD), requiring reporting both on the risks and impact of sustainability issues on an enterprise, as well as on the enterprises’ impacts on environment and society, including disclosing on how material impacts, risks, and opportunities (IROs) change over time.

According to Datamaran, the launch of the new tool comes as many organizations are still relying on resource-intensive and hard-to-scale manual spreadsheet-driven processes, with the new solution aimed at addressing these challenges, adding capabilities to Datamaran’s platform to enable companies to focus on what has changed since their previous assessment. The launch follows the release last year by Datamaran of its IRO Hub platform to help companies identify and manage material ESG issues.

Key capabilities of the new solution highlighted by Datamaran include the use of AI companies identify and manage material ESG issues to identify external shifts in regulatory landscapes, peer strategies, and stakeholder expectations, engagement with subject matter experts to streamline internal reviews, maintaining up to date materiality assessment to ensure regulatory compliance, providing a “single source of truth” including detailed documentation and audit trails, and providing a period-over-period view of evolving ESG risks and opportunities.

Marjella Lecourt-Alma, CEO and co-founder at Datamaran, said:

“Materiality is not static. Companies need a way to continuously monitor and refine their ESG priorities without repeating a cumbersome, manual materiality assessment every time. With our latest innovation, businesses can efficiently maintain compliance while also strengthening their ESG strategy in a dynamic and repeatable way.”

Founded in 2014, London-based Datamaran provides an AI-powered software analytics platform enabling companies to identify and monitor external risks, including ESG, offering real-time analytics on strategic, regulatory, and reputational risks, specific to users’ businesses and value chains. The company announced a $33 million investment from Morgan Stanley’s late-stage growth equity private investment platform Morgan Stanley Expansion Capital in 2024.