Guest Post: How the Dismantling of ENERGY STAR Could Change Sustainability Benchmarking

The proposed elimination of the famous program raises big questions about the future of data management and benchmarking in real estate.

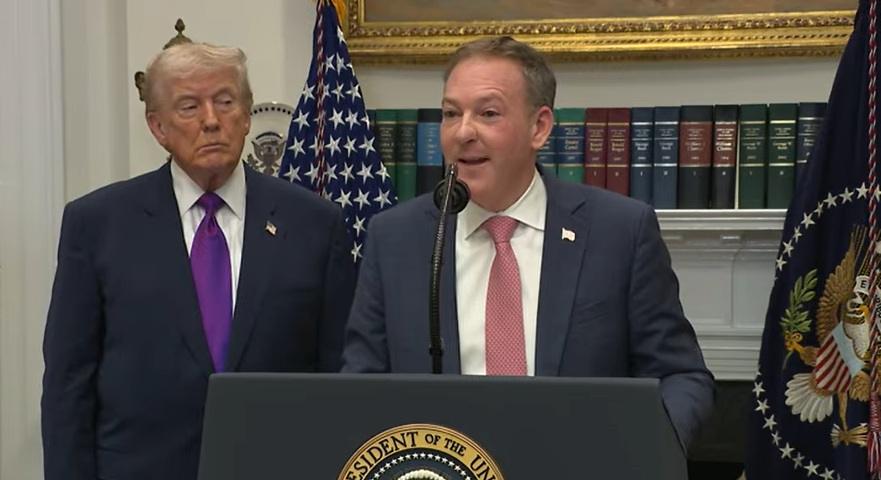

By Matt Ellis, CEO of Measurabl

While perhaps best known for consumer appliance labels, ESTAR’s (often overlooked) component – a software product called ENERGY STAR Portfolio Manager (ESPM) – acts as the backbone of energy and sustainability data management and benchmarking for the North American commercial real estate industry.

Supporting 330,000 buildings, across 35 billion sq. ft. of North American real estate, ESPM powers a variety of green loan programs from HUD to Fannie Mae, supports compliance with more than 60 state and local building energy performance standards, and facilitates institutional-grade reporting to all stripes of real estate stakeholders. It’s also the basis for the ENERGY STAR certification that helps real estate owners distinguish their building from the one down the street in terms of energy efficiency.

All of this is free – thanks to taxpayers who have funded the government-run program – and has produced a fantastic ROI of $350 for every $1 invested (according to EPA).

But with the U.S. administration proposing to eliminate ENERGY STAR, ESPM is set to go with it. That raises a pivotal question: how will real estate measure and benchmark energy and sustainability if ESPM disappears?

A New Way Forward

Doing nothing isn’t an option. Measuring and acting on energy and sustainability is more than a reporting exercise – it’s integral to efficiency, compliance, capital access, and long-term value. Energy-efficient retrofits yield an average ROI of 15–20% within five years, and BXP—the world’s largest publicly traded office REIT – has saved $2.2 million annually in energy costs since 2017 using Measurabl’s solution Optimize.

ESPM underpins this success, but if the status quo doesn’t hold, what should a replacement look like? When talking with our customers, which include many of the world’s largest real estate organizations, five key considerations are on their minds:

- Funding: Should we depend on taxpayer-funded tools to manage mission-critical software products and solutions?

- Benchmarking: Should performance standards be based on CBECS – a survey updated once every several years and based on a relatively small sample size?

- Politics: Should building data be placed in government programs vulnerable to shifting politics?

- Globalization: Should tools be North American-centric when real estate is a global business?

- Innovation: Can government offerings keep pace with dynamic regulatory and operational demands?

My takeaway from listening to the industry is this: the present situation is a forcing mechanism to confront systemic, significant gaps – ones that remain critical whether ESPM stays or goes.

A Blueprint for What’s Next

Today’s reality of interlocking global climate regulation, sophisticated investor scrutiny, portfolio-scale Op/CapEx decision-making, and the fundamentally international nature of the real estate industry, is far more complex than it was a quarter century ago. It coincides with a world where energy, carbon and environment are political, not just business considerations. What’s needed now and next, is a system designed with these considerations in mind.

Supporting U.S. regulations is not enough. Capital is global. Nor is a benchmark derived from a small survey conducted every few years (CBECS) sufficient to power real estate transactions done every day around the world. In the age of AI and data science, we should have transactional-grade metrics delivered near real time. Energy and GHG intensity, and climate risk exposure are financial inputs increasingly applied across underwriting, valuation, and leasing decisions. These datapoints must flow easily from one decisionmaker to another, and to the systems that assist them. The infrastructure need not be taxpayer funded nor exposed to political influence and ideology. It should be by industry, for industry. Real estate is the world’s largest asset class and its largest source of carbon emissions. Therefore resourcing should be commensurate with this scale and potential impact. Instead, ESPM relies on a budget of a few million per year.

I’ve distilled these questions and proposed solutions into five guiding principles should pave the way to a better benchmark and an improved business case for sustainability overall:

- For Industry, By Industry

Industry tools and data should be governed by the software users and data providers. - Market-Driven Innovation

Tools must evolve and improve at pace with the market. AI, automation, and dynamic benchmarking are all table stakes. - Globally Referenceable

Metrics should be consistent and comparable across portfolios and regions, to reduce regulatory friction, and investor confusion. - Agnostic

Alignment is key in an industry of real estate’s scale. Any organization that contributes or adds value to data should be able to participate. - Sustainable Business Model

Access to tools like data management, benchmarking and reporting should remain free. To ensure durability of the solution, and drive the pace of innovation and ROI called for, the platform must have transparent revenue streams.

Bridging the Gap

As the future of ESPM remains unclear, maintaining continuity is essential. Measurabl takes the potential discontinuation of ESPM seriously. As the world’s most widely adopted sustainability data platform after ESPM – and a six-time ENERGY STAR Partner of the Year – we’re ready to support the industry through any transition by offering free accounts. Our initial goal was to safeguard data. Our second goal was to provide continuity of day to day business activities like data aggregation, benchmarking, and reporting, which is why we included a range of sophisticated, enterprise-grade features in our free offering. What comes next will be a paradigm shift in the business model and toolkit offered to industry and the ecosystem that serves it.

We’re at an inflection point, and that’s a positive thing. For decades, ESPM helped prove the business case for sustainability. Now, we have the chance to evolve it. Whether ESPM stays or goes, the question before us remains the same: what do we want real estate’s future to look like? If we choose to act decisively, collaborate intentionally, and invest wisely, the answer could be a more profitable, resilient, and sustainable path forward for all.