Corporate Decarbonization, Supportive Policy to Drive 2023 Rebound in Sustainable Bond Market: Moody’s

Issuance volumes of green, social, sustainability and sustainability-linked (GSSS) bonds are expected to rebound in 2023, driven by growing pressure on companies to follow through on their decarbonization commitments, greater policy support for green spending and greater participation from government issuers, according to a new report from Moody’s Investors Service.

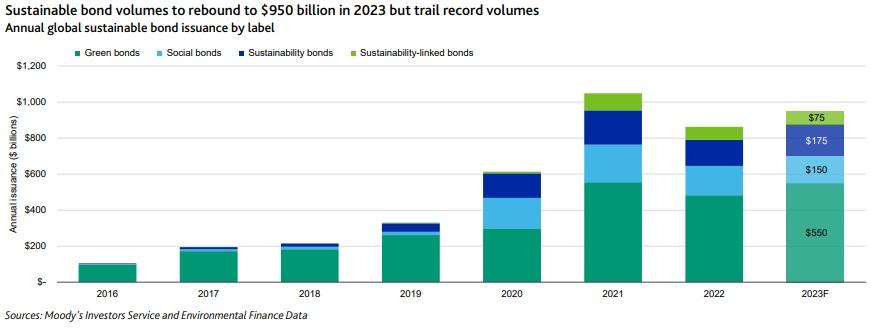

Moody’s forecasts the GSSS bond market to grow 10% in 2023 to issuance of $950 billion, after declining 18% in 2022 to $862 billion, from a record $1.05 trillion in 2021.

Despite the 2022 decline, the sustainable bond market substantially outperformed the global bond market, which saw issuance volume fall by 27%. GSSS bonds claimed a record 13% share of global bond issuance in the year, and Moody’s expects continued outperformance, with a forecast 15% share in 2023.

The report highlights the primary drivers and constraints anticipated to influence sustainable bond market in 2023, with growth to be led by factors including an increase in corporate issuers looking to finance their net zero ambitions, particularly in carbon intensive sectors that are facing growing pressure from investors to implement decarbonization plans. A more supportive policy environment, such as the recently passed Inflation Reduction Act in the U.S. and Europe’s REPowerEU plan, is also expected to help drive financing for growing clean energy investments. Additionally, Moody’s expects public sector issuers, including both sovereign and sub-sovereign to expand their sustainable bond issuances, particularly in emerging markets.

Moody’s expects many of the factors that caused issuance to slow in 2022 to continue to impact the market, including a challenging macroeconomic environment and rising rates, as well as a sharper focus on greenwashing risks leading to increased caution by potential issuers, which has disproportionately hit the sustainability-linked bond (SLB) market. Issuance volumes for SLBs were particularly weak in the second half of the year, as issuers faced scrutiny of the credibility and robustness of their linked sustainability targets, as well as the sector’s exposure to high-yield issuance.

By bond type, green bond issuance declined by 13% in 2022 to $482 billion, social bonds fell 22% to $163 billion, sustainability bond volumes were 24% lower and sustainability-linked bond issuance was down 23% for the full year.

Moody’s anticipates growth in each of the bond types in 2023, expect for social bonds, which are expected to continue to be impacted by lower pandemic-related financing.

In the report, Matthew Kuchtyak, Vice President – Sustainable Finance at Moody’s Investors Service, said:

“Companies in sectors with heightened inherent exposure to carbon transition risk will face growing pressure this year to follow through with credible implementation plans. Strengthening policy support for green capital spending in many countries, such as the Inflation Reduction Act (IRA) in the US, will also drive clean energy investments. As more issuers aim to finance their net-zero ambitions and transform their business strategies to adapt to rising policy and market risks, labeled sustainable bond issuance from companies in sectors highly exposed to carbon transition is likely to rise this year.”