Fitch Warns Water Risks Likely to Become Increasingly Relevant for Sovereign Ratings

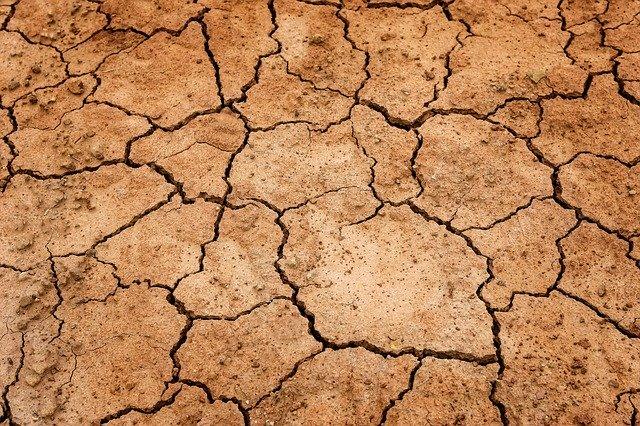

Credit ratings agency Fitch ratings anticipates water risks, such as droughts, floods and water stress, to become increasingly relevant as a sovereign ratings driver over the medium to long term. These risks will particularly come into focus in the event of severe climate change, according to the agency. Ultimately, each sovereign’s vulnerability to water risks will depend on its ability to devise and implement mitigating policies.

Fitch noted that large swathes of the world’s population, primarily in emerging countries, are already experiencing water stress, due to a rising imbalance between steadily growing demand for water and deteriorating availability of reliable supply. These trends are expected to increase and spread to additional regions. Meanwhile, climate change is expected to lead to higher incidence of destructive droughts and floods.

The ratings agency stated that countries in the Middle East and Mediterranean basin, including Egypt, Israel, Jordan, Kuwait, Morocco, Saudi Arabia and Tunisia, are particularly exposed to droughts and water stress. Several south Asian and African countries, such as such as Bangladesh, Sri Lanka, Thailand and Vietnam, Benin, Mozambique and Rwanda. are especially exposed to flood risks. Fitch’s composite water risk indicators incorporate measures of current country exposure to water risks as well as of projected climate change under the intermediate emission scenario RCP4.5.

According to Fitch, the rating impact of water risks will to increase over the medium to long term. Water risk impacts on economic growth include potential drops in agricultural yields in some regions and global shifts in production, affecting some agriculture-dependent economies. Public finances may be affected as well, through growing spending pressures, generating contingent liabilities for sovereigns. Fitch warns of potential long-term consequences including domestic social tensions arising from income distributions and food security issues, and even of geopolitical conflict or crises arising from disputes regarding common resources in transboundary river basins and aquifers.

Fitch stated that it aims to capture the impact of water risks on structural features, macroeconomic performance and public and external finances, through the agency’s sovereign rating framework. Countries where droughts or floods have already been mentioned among challenges to growth, external finances and/or inflation in the context of a negative rating action include Morocco (March 2020), Namibia (June 2020), Sri Lanka (December 2018), Thailand (March 2020), Uruguay (October 2018) and Zambia (April 2020).

Additionally, Water Resources and Management are one of the five environmental factors captured under Fitch’s ESG relevance scores. Three countries, Egypt, Laos and Namibia, already have and ESG relevance score of ‘3’ on this metric.