Global Pension Managers Partner on SDG-identifying Platform For Investors

A group of pension asset managers including APG, AustralianSuper, British Columbia Investment Management Corporation (BCI) and PGGM announced today the launch of the Sustainable Development Investments Asset Owner Platform (SDI AOP). The group, representing assets exceeding $1 trillion developed the platform to enable investors to assess companies on their contribution to the UN Sustainable Development Goals (SDGs). The platform utilizes both standard and artificial-intelligence driven data, and will be available via distribution partner Qontigo.

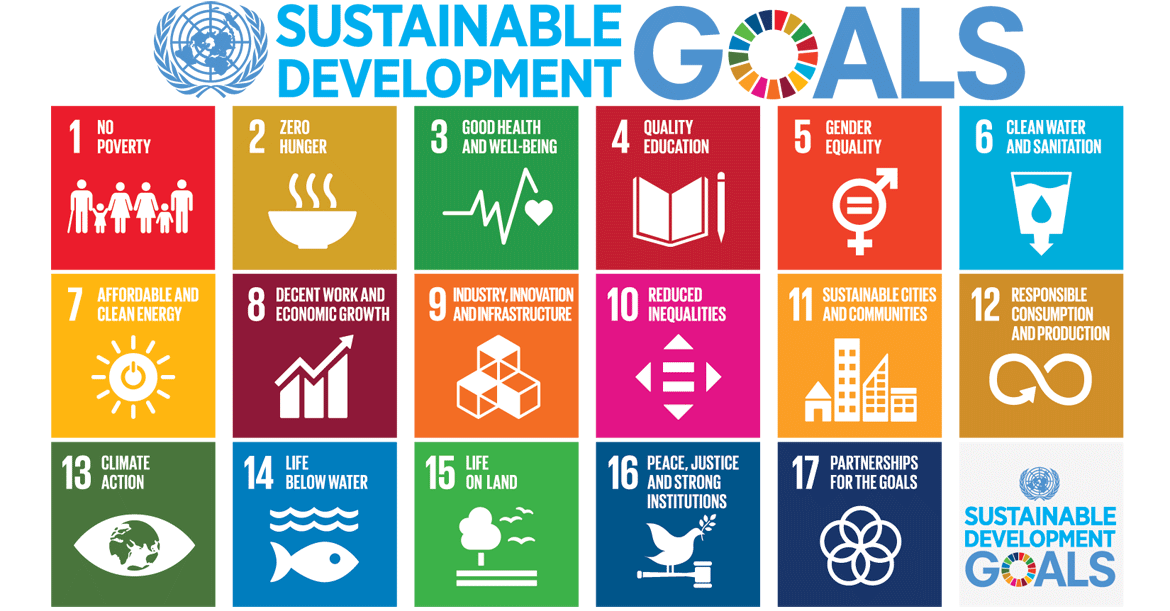

“SDGs” refer to the 17 categories of Sustainable Development Goals adopted by world leaders at the United Nations Sustainable Development Summit in September 2015, with the aim to protect the planet and improve quality of life globally. The UN SDGs set targets to achieve a broad range of aspirational goals, including ending poverty and hunger, improving education, and protecting the environment. Investments in companies whose products or services contribute to the realization of the SDGs are called Sustainable Development Investments (SDIs).

The group stated that while investors increasingly consider the SDGs relevant to their investment strategy, policy, asset allocation, investment decisions and active ownership, a lack of quality data to identify contributions to the SDGs has been an impediment for investors, and companies struggle to adapt their disclosures to meet investor needs. The new platform is aimed to helps investors to imbed the SDGs into their investment processes.

The SDI Asset Owner Platform provides a common definition, taxonomy, and data source for investments into the SDGs. Powered by AI-technology, data science company Entis generates SDI classifications for 8,000 companies to date. This enables investors to assess their global capital markets’ portfolios on their contribution to the SDGs and to report to their clients and external stakeholders transparently and consistently, using a common and auditable standard. The SDI classifications will be commercially available through Qontigo. The SDI definition and taxonomy are public and equally applicable to private market investments.

The SDI AOP is asset owner-led and asset owners make all methodological choices. The platform builds on the direct input and feedback from asset owners and their managers, and feeds the participating asset owners’ policy and investment needs into the assessment process. Subscribers and other stakeholders will also be invited to provide feedback. The SDI Asset Owner Platform will host a virtual event in September to provide interested investors with additional insight into the workings of the platform.

The development of the platform was initiated last year by Netherlands-based APG and PGGM, at the behest of their pension fund clients ABP, bpfBOUW and PFZW, and were later joined by AustralianSuper and BCI. The group announced that they welcome investors across the globe to subscribe, and create a critical mass of investors who together define the meaning of investing in the SDGs.

Claudia Kruse, Managing Director Global Responsible Investment & Governance, APG said:

“The SDGs are global and launching this standard with asset owners from three continents shows our commitment to contribute to the SDGs, and we look forward to extending the collaboration. SDGs and AI-based technology are at the forefront of innovation. This investment is part of our commitment to our clients on whose behalf we invest in order to provide affordable pension in a sustainable world.”

Andrew Gray, Director ESG and Stewardship, AustralianSuper, said:

“As a founding member of the SDI AOP, AustralianSuper strongly welcomes the opportunity to jointly establish a global standard for investors to identify sustainable development investments. The platform will progress how we assess and engage with investee companies on their SDG contribution, measurement and reporting. This will promote real world sustainable outcomes which are vital for creating long-term value for beneficiaries.”

Jennifer Coulson, Vice President ESG, BCI, said:

“Standardization of data is one of the biggest challenges facing the environmental, social, and governance (ESG) landscape. For this reason, we are excited to be part of this asset-owner led initiative which sets a global standard on SDG contributions for all investors and brings consistency and comparability to company-level data. This is the type of quality data that BCI relies on when making investment decisions that are required to generate value-added returns for our clients.”

Eloy Lindeijer, Chief Investment Management, PGGM, said:

“For PGGM this platform is an important next step in a process to mobilize ever more institutional capital around the big challenges of our time, as described in the SDGs. By collaborating with asset owners from different continents we hope that this SDI AOP will contribute to being a global standard for investors.”

Sebastian Ceria, Chief Executive Officer, Qontigo, said:

“The application of transparent rules-based methodologies, common definitions, taxonomies and strong data are the bedrock elements required for effective sustainable investing. We are proud to be a part of the SDI Asset Owner Platform’s efforts to enhance the ability of investors to achieve their commendable goals in sustainable investing.”

Wim Scheper, Managing Director, Entis, said:

“Contributing to the development of a global standard for SDG investments is truly inspiring. It will guide the decision-making by investors and companies towards a more sustainable world.”