Guest Post: Connecting the “D” to the ESG

By: Christine Tan, PhD, Co-founder and Chief Research Officer of idaciti

The world is grappling with dramatic shifts in climate change, environmental, social, and geopolitical events. In a world of rapid digital transformation, how do companies, investors, regulators, standard setters, and ordinary citizens respond to these shifts? The ESG challenges are wide and varied, many of which might seem insurmountable without the technological solutions available to us today. And, different stakeholder groups have their particular interests in solving these challenges. Perhaps it takes this global village of humans (and technology) to work together to rise to these challenges.

Under Pressure

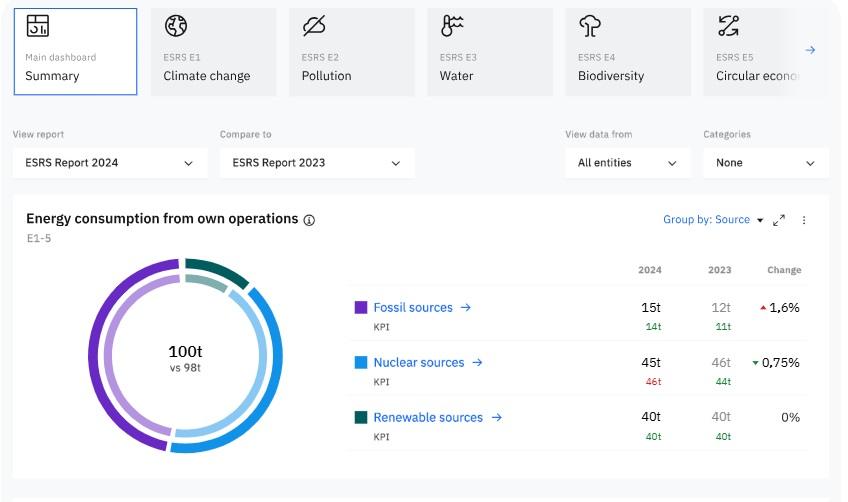

Current trends show that the focus on ESG reporting has become a business imperative. The recent annual 2022 CEO and Senior Business Executive Survey shows that, for the first time in the history of this survey, environmental sustainability has jumped into the top ten business priorities that CEOs must contend with, only slightly behind digital transformation and cybersecurity. This is driven by the increased demand by investors and other stakeholders (like consumers) who want businesses to act more on sustainability initiatives. Consumers are using ESG factors to make their buying decisions. As a result, CEOs are now viewing ESG strategies and reporting as a way to differentiate their companies from that of their peers, and more specifically as opportunities to drive business efficiencies, revenue growth and attract investors and customers. Incorporating digital transformation efforts into the ESG reporting process is one way CEOs can supercharge stakeholder firm value. For instance, CEOs can invest in dashboards to monitor, in real-time, trending or emerging ESG topics amongst peer companies or within the industry. This can help companies identify their own ESG shortcomings and strengths relative to their peers, allowing them to increase their agility on closing the gaps in their ESG initiatives and reporting. More importantly, companies can better position themselves to investors and customers. The pressure is on for CEOs to step up and meet the challenge. Connecting digital and ESG efforts may help them do just that.

Living in a (Double) Material World

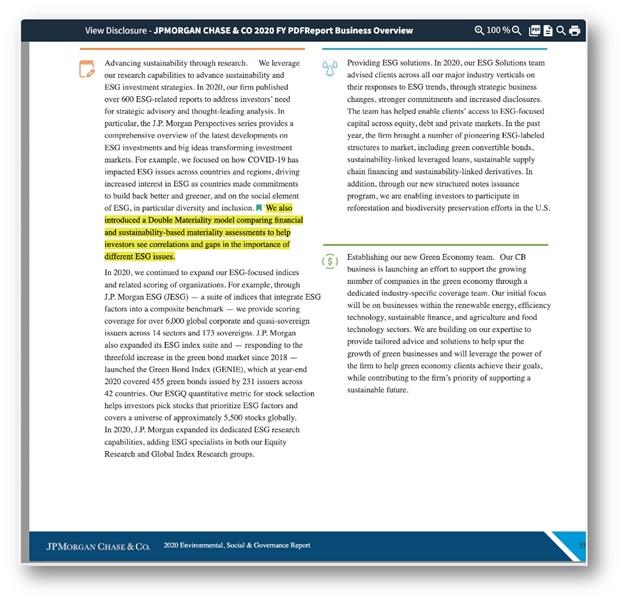

Leading the charge on sustainability reporting, the European Union introduced a two-pronged materiality concept, coining it ‘double materiality’. In essence, the first prong relates to the concept of financial materiality; and the second relates to environmental and social materiality. Through this double-materiality lens, the company reports how sustainability matters may impact the company, and how the company affects society and the environment. Large investment firms like JPMorgan have seized the opportunity to develop double materiality investment models to assess financial and sustainability-related materiality factors in facilitating investment decisions.

With this current excitement among investors to incorporate ESG data into their investment process, let us not forget or diminish the role that financial data has played (for over many decades) in the analyses of companies. Double materiality connects ESG and financial data and unifies the lens. Specifically, investors need timely, credible, high quality ESG and financial data for analyses. Connecting digital data with investors facilitates this.

Digital Killed the Paper Based Star

Companies around the world have done away with the antiquated practice of creating paper-based or static, digital financial statements. Instead, they have been structuring and reporting their financial statements in an interactive, digital format. As a result, reported financial data in the financial statements are immediately available and electronically analyzable by all stakeholders. In the U.S., this digitization initiative started in 2009 when the SEC mandated that companies ‘tag’ their financial statements using XBRL, the global digital reporting standard. Recent initiatives by regulators and standard-setters indicate that the winds of change are blowing into ESG reporting. For example, the recently established International Sustainability Standards Board (ISSB) has stated its goal to develop the IFRS Sustainability Disclosure Taxonomy for digital reporting. Digital tagging requirements sit front and center in the SEC’s hotly anticipated climate rule disclosure. Recently finalized, the SEC’s Pay Versus Performance Rule requires companies to disclose in the proxy statement or any consent solicitation material the compensation-related information and additional information linking executive compensation to company financial performance. Importantly, the SEC requires companies to digitally tag this disclosure. Regulators and standard-setters recognize that, in order to meet investors’ and other stakeholders’ thirst for timely financial and ESG-related data, the financial and ESG disclosures must be digitally structured. Connecting digital data to the capital markets increases market efficiencies, and facilitates useful decision-making.

Dawn of the Digital Data Age

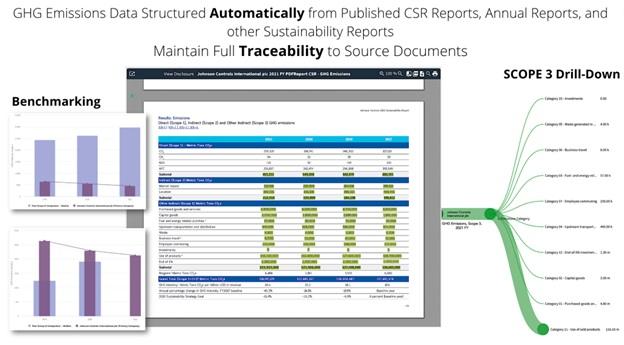

There are many ways to digitally structure financial and ESG reporting. The approach taken by companies, regulators and standard-setters around the world is to leverage the time, technology and country-proven XBRL digital reporting standard to structure this information. Whilst purely AI/ML-driven solutions may accomplish some of this digital structuring, the breadth and complexity of both quantitative and qualitative financial and ESG disclosures require some human judgment and touch in the loop. Inherent in the XBRL DNA is metadata which provides traceability for each structured data point back to the source location, providing credibility and verifiability to the data.

XBRL embeds structured quantitative data within the narrative discussions, allowing both humans and machines alike to garner richer and nonlinear insights. In a nuanced world, where humans and machines co-exist, machines and humans cannot work in silos. Standing on the shoulders of computing power, humans can add significant insights to latent social and language content contained in disclosures. It might just take this collaborative intelligence between the global virtual and real villages to tackle the ESG challenges.

About the author:

Christine Tan, PhD, is the Co-founder and Chief Research Officer of idaciti. She is also a professor in accounting at Hunter College – City University of New York. At idaciti, Christine oversees all research and development functions related to financial data analyses, data quality assurance and the application of machine learning to financial and non-financial datasets. Prior to that, she was the XBRL Project Manager at the Financial Accounting Standards Board (FASB) for two years from 2010-2011. At the FASB, she led the team that was responsible for updating the US GAAP Financial Reporting Taxonomy for new accounting pronouncements, common reporting practices and for ongoing taxonomy architectural developments. Christine was also part of the core team at XBRL US that was contracted by the Securities and Exchange Commission to design and build the XBRL US GAAP Taxonomy. She was a member of the FASB’s Taxonomy Advisory Group for ten years, and is a current member of the IFRS Taxonomy Consultative Group and the SASB/VRF Taxonomy Review Committee. Christine is also on the Board of Directors and Treasurer of XBRL International. Her consulting experience spans a number of Fortune 500 companies, government agencies, investment banks and private equity firms on matters related to financial reporting, financial data analyses, XBRL and quantitative analyses of large financial data sets. She received her Ph.D. in Accounting and Finance, and a Bachelor of Commerce and Economics with First Class Honors from the University of Melbourne in Australia.