Guest Post: ESG and Impact – Why We Need Both for Meaningful Change

By: Evan Vahouny, Chief Impact Officer at Proof of Impact

When I first started my career, I was an impact investing enthusiast. I was infatuated with social impact bonds and deep outcomes measurement, convinced they were the only path to saving the world. While I still believe that mobilizing the private sector to solve global challenges is the most effective way to rapidly move the needle, I have since learned that the planet and our fellow inhabitants don’t care about waiting for the perfect answer or promised solution – they care about concrete action, measurable progress, and radical transparency.

At Proof of Impact, we’ve worked with both investors and companies who have a wide range of different motivations. In this work, we’ve noticed a growing trend: the widespread use of either “ESG” or “impact” to describe data-driven measurement and operational improvement efforts. However, rarely have organizations used ESG and impact together. This is largely because ESG and impact seem to be two different worlds that exist side by side, with different cultures, languages, and approaches to using data to drive positive change. Only recently have the two worlds met – or rather collided.

Indeed, there have been a few harsh critiques of the ESG world in recent months from those in the impact world (The World May be Better Off Without ESG Investing, ESG Investing Needs to Expand its Definition of Materiality), many of which may be warranted (e.g., ESG Mirage, ESG Funds Managing $1 Trillion Stripped of Sustainability Tag). But what is the difference between ESG and impact? Based on our in-depth work with ESG and impact measurement here at Proof of Impact, we have noticed three primary differences between the two approaches:

- Internal vs. External Focus: As differentiated in the Global Impact Investing Network’s IRIS+ metric catalog, ESG tends to focus on operational issues that are internal to the business, such as workforce diversity, energy consumption, or waste management. On the other hand, impact tends to focus on the external effects of the organization’s product or service on the customers and the world, and includes measures such as healthy product usage, reductions in greenhouse gas emissions from using the product versus the alternative, and improvements to stakeholders’ social outcomes and well-being. These external metrics are generally more specific to a company’s individual product or service.

- Avoiding Harm vs. Contributing to Solutions: An organization’s underlying motivation is another key difference. The Impact Management Project’s ABC Classification breaks down three different types of motivation that organizations may have when considering sustainability in their strategy:

- Avoiding harm (e.g., to mitigate risk)

- Benefiting stakeholders (e.g., to positively affect stakeholders to sustain long-term financial performance), and,

- Contributing to solutions (e.g., to help tackle the education gap).

ESG is generally characterized in the “Avoid harm” category, whereas impact is characterized in the “Contribute to solutions” category. Importantly, both ESG and impact fall into the “Benefit stakeholders” category.

- Frameworks: As a byproduct of the two differences above, a number of frameworks have emerged to service organizations primarily motivated to avoid harm, and so focus on ESG, whereas other frameworks have emerged to service organizations who are motivated to contribute to solutions, and so focus on impact. The venn diagram below provides a few examples of frameworks and other key differences.

As with everything, there are also gray areas that do not fit neatly into a venn diagram, such as reducing greenhouse gas emissions from a company’s internal operations by modifying the product. For example, a consumer packaged goods company may use refurbished parts to reduce its manufacturing emissions, and this is both a central ESG measure as well as a critical impact outcome. While these gray areas exist, however, it is important to differentiate between ESG and impact approaches.

ESG vs. Impact: Why Does it Matter?

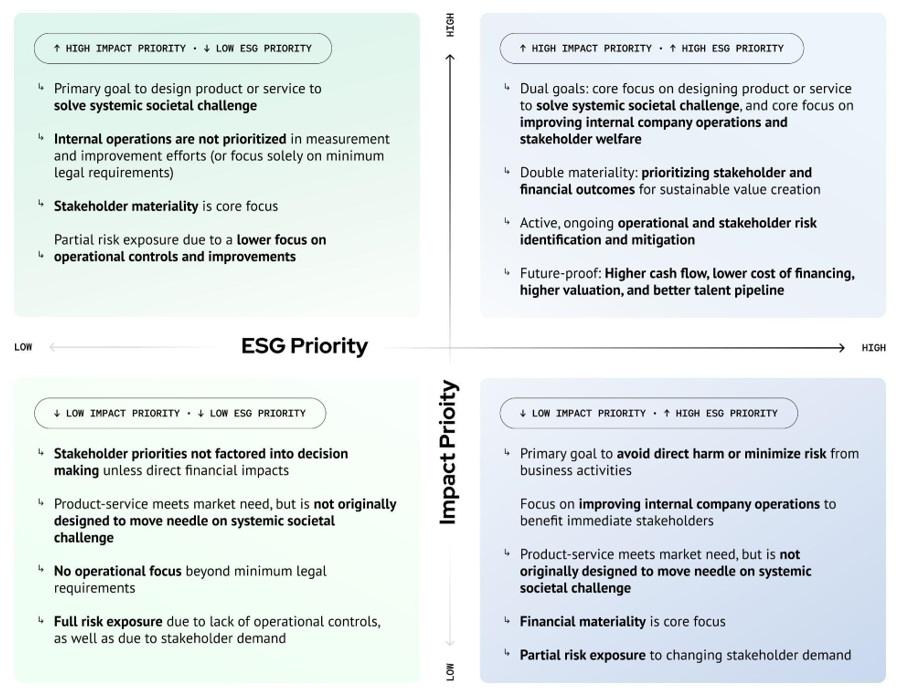

For companies and investors who want to be comprehensive in their approach, speak the language of all their stakeholders and shareholders, and ensure they’ve accounted for all of the relevant risks and opportunities, realizing this difference and positioning the organization properly can have significant effects on short- and long-term outcomes. The matrix below details how organizations that prioritize both ESG and impact will be best positioned to create sustainable value.

Purpose and Profit

Companies focusing on both ESG and impact typically target the outcomes set out in the top right of the above matrix. However, even with the best of intentions, this isn’t always possible. First, it takes time and resources to establish comprehensive ESG and impact coverage, and many companies (especially smaller ones) don’t have this capability. This is why it’s so important for companies and investors to focus and prioritize their efforts by not only considering the recommended metrics from leading frameworks (both ESG and impact), but also further narrowing that list by conducting a double materiality assessment. This involves gathering feedback on the issues (and metrics) that have both the most business value and the highest stakeholder importance, and then acting first on those issues.

Crucially, this means looking not only at issues that are financially material to the business (i.e., only using SASB measures), but working to both avoid harm and contribute to solutions, and considering both operational and product service impact. If companies and investors take this comprehensive approach in selecting their priority issue areas, using reliable (and validated) data to consistently track and share their progress, and take action to improve their baseline over time, they will be investing in the long-term, sustainable success of their business, as well as that of the people and environments it affects.

The overarching goal of both ESG and impact is for businesses and investors to change the trajectory of the status quo on issues that matter most to stakeholders and shareholders. In the achieving of this goal, ESG mustn’t be simply window dressing for profit-driven companies to make more money, and impact mustn’t simply be an academic exercise designed for nonprofit or government entities. Instead, the motivations, frameworks, and metrics used in each world must be combined. Without acting on both of these perspectives, investors and companies may face avoidable business risk and miss opportunities to create sustainable value for stakeholders and shareholders alike.

If you’d like to learn more about how to position your fund or company with a comprehensive ESG and impact strategy, visit us at Proof of Impact or reach out at hello@proofofimpact.com!

About the author:

Evan Vahouny is the Chief Impact Officer at Proof of Impact, a technology company that enables the real-time collection, verification, and analysis of ESG and impact data. Our mission is to provide investors and companies with a comprehensive view of their past and predicted ESG and impact performance as they accelerate their path to sustainable value creation.