Sun Life’s SLGI Asset Management Launches Sustainable Infrastructure Fund

Sun Life’s subsidiary, SLGI Asset Management Inc, announced today the launch of Sun life KBI Sustainable Infrastructure Private Pool, a new fund targeting the massive investment opportunities in the rapidly growing market for sustainable infrastructure. The fund is sub-advised by KBI Global Investors.

According to SLGI, the new investment fund will in the equity of companies globally that own or operate sustainable infrastructure assets, or benefit from the development of these assets. Focus areas of investment will include water and food infrastructure, and technological advances in clean, efficient, renewable sources of energy.

The launch of the new fund follows the announcement earlier this month by SLGI parent Sun Life of a new goal to achieve net zero GHG emissions in its operations and investments by 2050. SLGI also announced that it is joining the Net Zero Asset Managers Initiative, an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner.

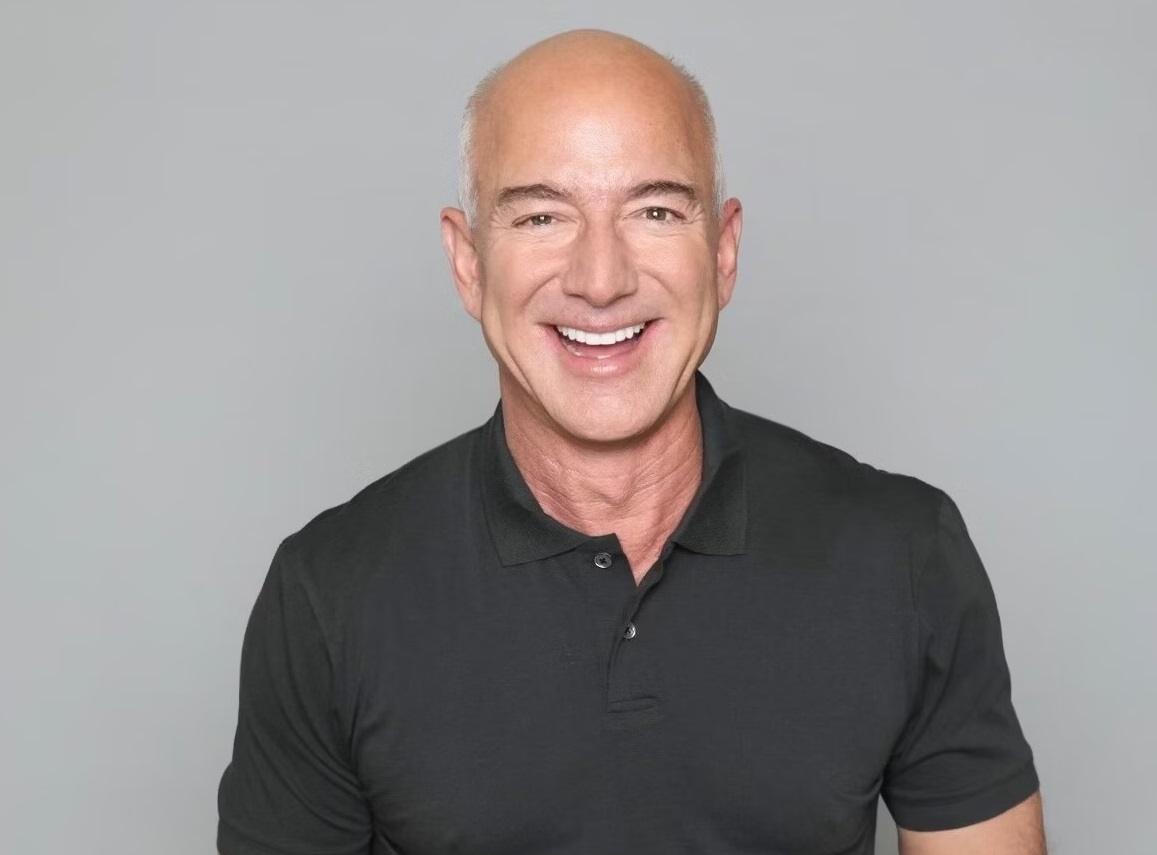

Oricia Smith, President, SLGI Asset Management, and Senior-Vice President, Investment Solutions, Sun Life Canada, said:

“At SLGI Asset Management, we’re proactively seeking new ways to become more sustainable across all facets of our organization. We believe there is an intersection of sustainable investments and investment opportunities that are financially beneficial for investors. Launching the Pool broadens our platform of investment solutions available to Clients. It also builds on our commitment to investing strategies that drive long-term sustainable outcomes while helping investors build wealth and secure their financial future.”