Carbon Markets Startup Cloverly Raises $19 Million

Climate tech startup Cloverly announced today that it has raised $19 million, with proceeds aimed at developing its voluntary carbon markets (VCM) infrastructure platform and expanding its team and global presence.

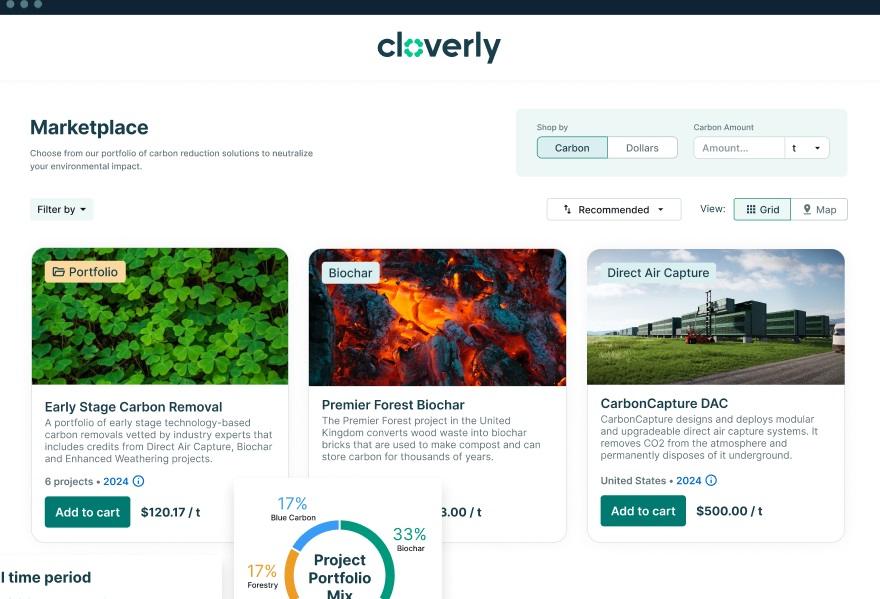

Atlanta-based Cloverly was launched in 2018 as an API to calculate the amount of carbon emissions from an activity and to purchase carbon offsets in real time to address this impact. The company has also launched a new supplier platform offering credits from several carbon removal suppliers, and also offers software enabling suppliers to manage commercial operations.

Demand for carbon offset projects that counteract the release of greenhouse gases, and related credits, is expected to increase significantly over the next several years, as companies and businesses increasingly launch net zero ambitions, and turn to offsets as a bridge to their own absolute emissions reduction efforts, or to balance difficult to avoid emissions. Cloverly enables businesses to scale climate action either through the purchase of carbon credits, or by embedding its technology into their products, services and supply chains.

Jason Rubottom, CEO of Cloverly, said:

“The importance of the voluntary carbon market demonstrates an unprecedented demand for solutions that allow both businesses and consumers to actively contribute to critical climate action. Cloverly is uniquely positioned to facilitate that engagement and this funding round represents that.”

The company said that the proceeds from the Series A funding round will be used to fund the development of its VCM infrastructure, including the new supplier platform, as well as to support a major headcount expansion, with plans to triple its team, and for the launch of a second headquarters in London.

The funding round was led by technology-focused venture capital investor Grotech Ventures, and included participation from new investors Aquiline Technology Growth, Impact Engine, Mission One Capital, New Climate Ventures, and CreativeCo Capital, and existing investors Tech Square Ventures, SoftBank Opportunity Fund, Circadian Ventures, Knoll Ventures, SaaS Ventures, and Panoramic Ventures.

Lawson Devries, General Partner at Grotech Ventures, said:

“Through our due diligence, we spoke to many of Cloverly’s customers. We were struck by the passion they had for Cloverly’s product and team. It became clear that Cloverly has not only established itself as a global leader in a large market but that they were bringing real value to their stakeholders and positively impacting the larger fight against climate change. We are excited to be a part of that.”