Deloitte, Persefoni Partner on Carbon Measurement Solutions for Banks & Insurers

Global professional services firm Deloitte and climate management and accounting platform (CMAP) provider Persefoni announced today a new strategic partnership aimed at developing analytics solutions for the banking and insurance companies to measure and manage their operational and portfolio carbon footprints.

The collaboration comes as financial firms face increasing pressure from regulators and other stakeholders to address their climate impacts, and to begin to put their net zero plans into action. Financing and investing activities typically make up the vast majority of financial institutions’ climate impact, with financed emissions often hundreds of times greater than operational emissions. Recent studies, however, indicate that most financial firms are still at the early stages of assessing their own climate exposure.

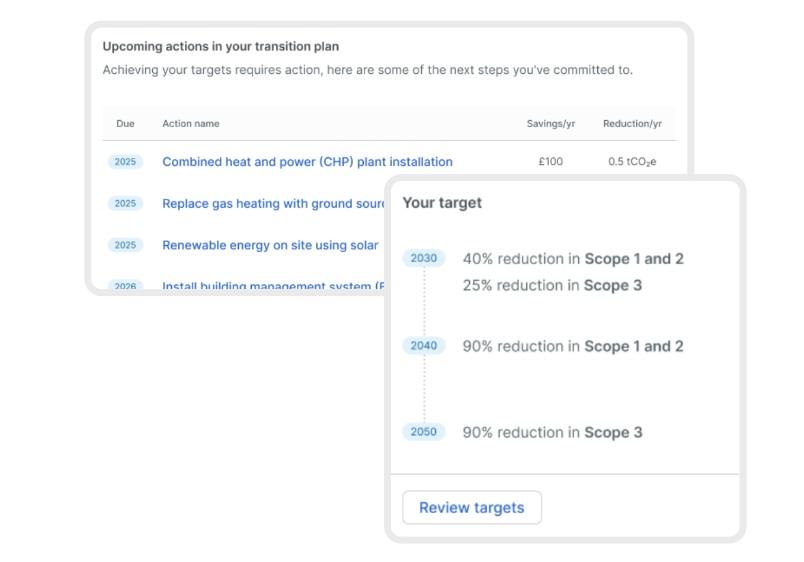

Launched in 2020, Persefoni’s SaaS platform enables companies and institutional investors to measure, analyze, plan, forecast, and report on their carbon footprint. Earlier this year, the company unveiled the Persefoni Portfolio Analytics Suite, a new toolset of solutions and dashboards aimed at enabling financial institutions to track, manage and reduce the greenhouse gas emissions associated with their investment portfolios and financing activities.

Persefoni CEO and co-founder Kentaro Kawamori said:

“Enabled by Persefoni’s best-in-class technology platform and Deloitte’s leading sustainability, digital transformation, risk, advisory, and reporting services, our shared clients in the banking and insurance sectors will have access to the best possible support on their climate journeys — from meeting compliance requirements to analyzing climate exposure within their portfolios and optimizing business strategies.”

Under the new collaboration, Deloitte that it has developed and integrated accelerators, analytical tools and capabilities to help its financial services clients understand risks and value-creation opportunities based on financed emissions portfolio data.

Ricardo Martinez, Deloitte Risk & Financial Advisory’s sustainability, climate and equity practice leader for financial services, said:

“Leveraging the rich data in Persefoni’s platform alongside Deloitte’s related analytics and services, we can help organizations through their end-to-end ESG transformation. As banks and insurance organizations look to address carbon accounting requirements by understanding and evolving the financed emissions in their portfolios, our shared clients will be able to chart those financed emissions, analyze critical business risks, identify opportunities to enhance the composition of their financed portfolio, and prepare to meet their disclosure and reporting obligations.”