BlackRock’s eFront Partners with Clarity AI on ESG Data for Private Markets Investors

ESG analytics and data science platform Clarity AI announced today a new partnership with BlackRock’s alternative investment management platform eFront, enabling private market investors to generate quantitative sustainability assessments of their alternative investment portfolios.

According to the companies, the partnership aims to “help solve the gap of sustainability metrics outside publicly listed companies,” and promote communication across LPs, GPs and portfolio companies.

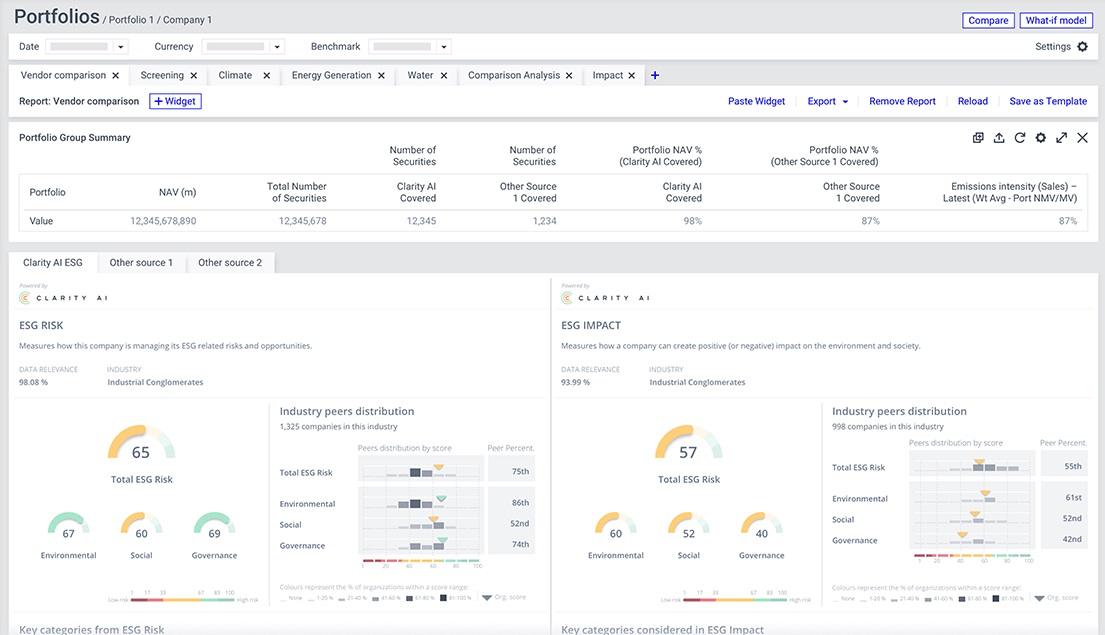

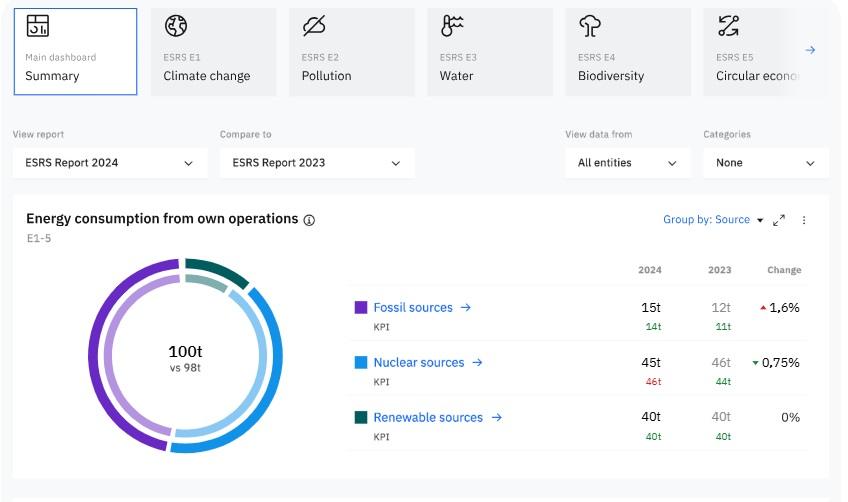

Clarity AI is a pure-play impact evaluation and assessment technology platform, designed to enable investors to manage the impact of their portfolios. The platform uses big data and machine learning to create actionable sustainability and impact insights and expand these to a uniquely broad universe of companies, countries, and local governments, and supports regulatory and client reporting to help investors meet new sustainability disclosure obligations, such as those required by SFDR and EU Taxonomy regulations.

BlackRock announced in January 2021 that it had invested in Clarity AI, and subsequently participated in a $50 million funding round for the company in December. BlackRock has integrated Clarity AI’s capabilities into its own Aladdin operating system for investment professionals and recently announced that it will utilize Clarity AI’s platform to support enterprise reporting for the EU’s SFDR framework.

Melissa Ferraz, Managing Director and Global Head of eFront Insight at BlackRock, said:

“Our partnership with Clarity AI will better help clients understand climate-related exposures and opportunities, while also giving them greater transparency with regulators and the end-investor—as sustainability frameworks become more and more standardized. We are confident that we are bringing powerful, and user-friendly, sustainability analytics to our clients with Clarity AI’s capabilities integrated into eFront.”

Under the new partnership, LPs opting into eFront’s sustainability service will have access to Clarity AI’s ESG data related to their portfolios and utilize that data within their reporting, while GPs will be able to generate company-, fund- and portfolio-level analytics and benchmarking, along with key sustainability metrics including emissions and total energy consumption.

Rebeca Minguela, Founder and CEO of Clarity AI, said:

“We are excited to partner with eFront to bring our capabilities to the global private markets. Our technology allows us to provide sustainability solutions at scale, and our ability to estimate data with proprietary machine learning algorithms sets us apart as a sustainability data provider that can address the needs of the players in the private markets almost immediately.”