ISS Acquires Muni Bond ESG Scoring Provider ACRe Data

Leading corporate governance and ESG data and analytics company Institutional Shareholder Services (ISS) announced today the acquisition of municipal bond ESG score provider ACRe Data. ACRe Data will become part of ISS’ responsible investment arm ISS ESG.

Marija Kramer, Global Head of ISS ESG, said:

“In today’s marketplace, vendors offer snapshots of data, or views of municipal issuers, but only ACRe links the social, economic, and environmental data into one view that our clients will now be able to access. Importantly, the transaction is in keeping with our commitment to clients to continue to expand our offerings beyond those designed primarily for equity securities.”

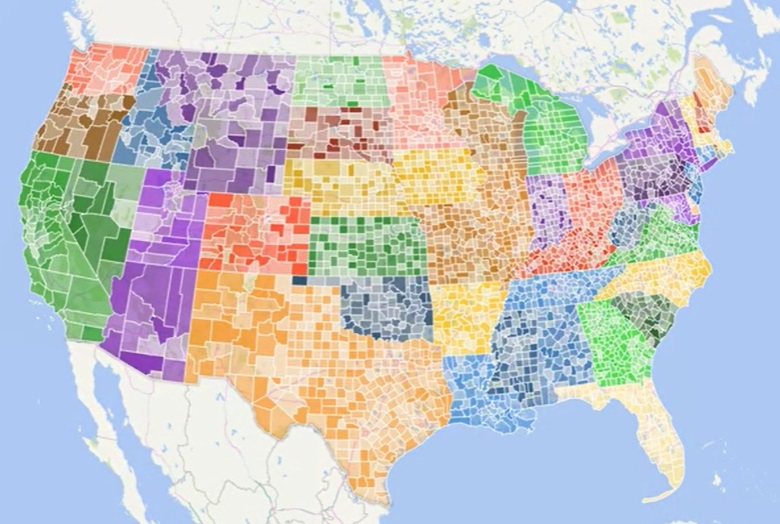

Founded in 2015, ACRe has become one of the largest provider of ESG Scoring for the U.S. Municipal marketplace. The firm provides ESG rankings and scores on approximately 3,140 U.S. counties, 29,000 cities and towns, 14,300 school districts, 8,700 opportunity zones, and all 50 states. ACRe’s datasets provide measurements for ESG risks spanning issues including climate change, crime, cost of crime, cyber risks, flood risks, health risks, infrastructure repairs, safe drinking water violations, and demographic data, among others.

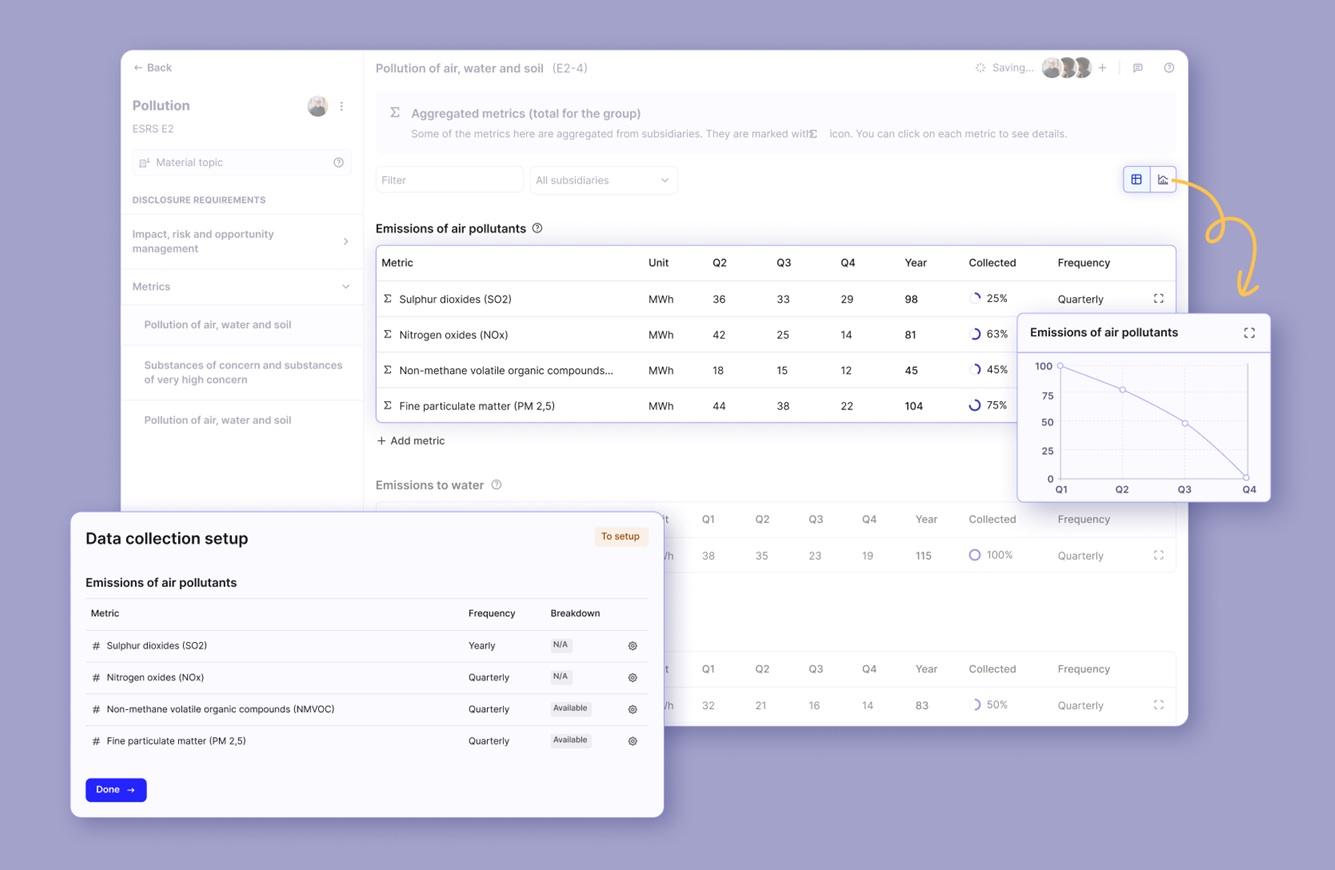

ACRe’s ESG Scoring, Ranking Data, and underlying data can be licensed through Bloomberg, Open:FactSet, or directly from ACRe Data. According to ISS, clients will be also be able to access the offerings via ISS’ DataDesk platform later in 2021.

John McLean, founder and Managing Director of ACRe, said:

“The ACRe team, with more than three decades of experience and excellence in designing leading fixed income analytics, pricing models, and trade analysis, is extremely pleased to join ISS in supporting its mission to provide institutions with world-class and cutting-edge ESG solutions. We look forward to working with Marija and the entire ISS ESG team to build upon their success in delivering a robust and comprehensive suite of responsible investment offerings spanning a variety of asset classes.”

The announcement marks a continuation of the consolidation in the ESG services, data and analytics space. Recent transactions include ISS itself, which in November 2020 announced an agreement to be acquired by international exchange organization Deutsche Börse in a deal valuing ISS at approximately $2.3 billion. The Deutsche Börse deal is expected to close in the first half of this year.