Lyxor Enables Assessment of Funds’ Climate Impact with Launch of Temperature Scores

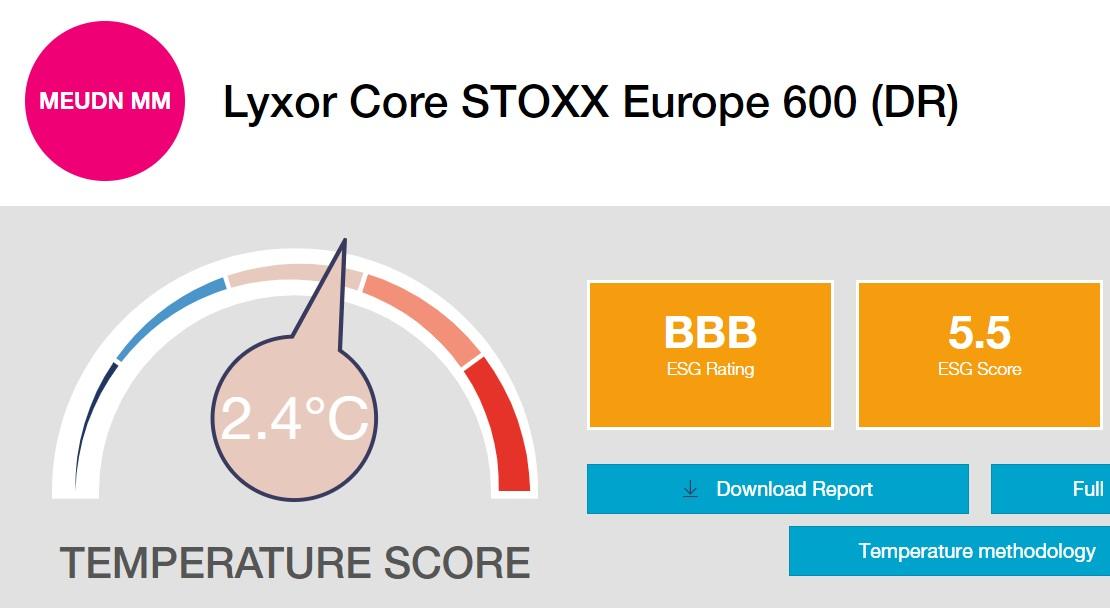

Lyxor Asset Management announced today the launch of a new tool aimed at enabling investors to assess the impact of their portfolios on global warming, with the publication of the temperatures currently implied by more than 150 of the firm’s Exchange Traded Funds (ETFs). The company expects to announce temperatures for more of its ETFs in the future.

According to Lyxor, the new measurement aims to give investors and stakeholders the transparency they need to become more aware of the impact their investments might have on the environment and to limit climate risks within their portfolios. The company said that the new initiative reinforces its efforts to give investors simpler ways to redirect their capital towards investments promoting a low-carbon world.

Lyxor stated that its approach to measure the temperature of the funds combined two methodologies, including the Sectoral Decarbonisation Approach (SDA), developed by the Science Based Targets Initiative (SBTi) for sectors with high greenhouse gas emissions, such as electricity production, steel production and aviation, and the Greenhouse gas Emissions per unit of Value Added (GEVA) approach for other sectors. In its assessment, Lyxor studied both past emissions data and future emission projections for each company within the funds, based either on commitments announced by the companies themselves, or on estimates provided by S&P Global Trucost.

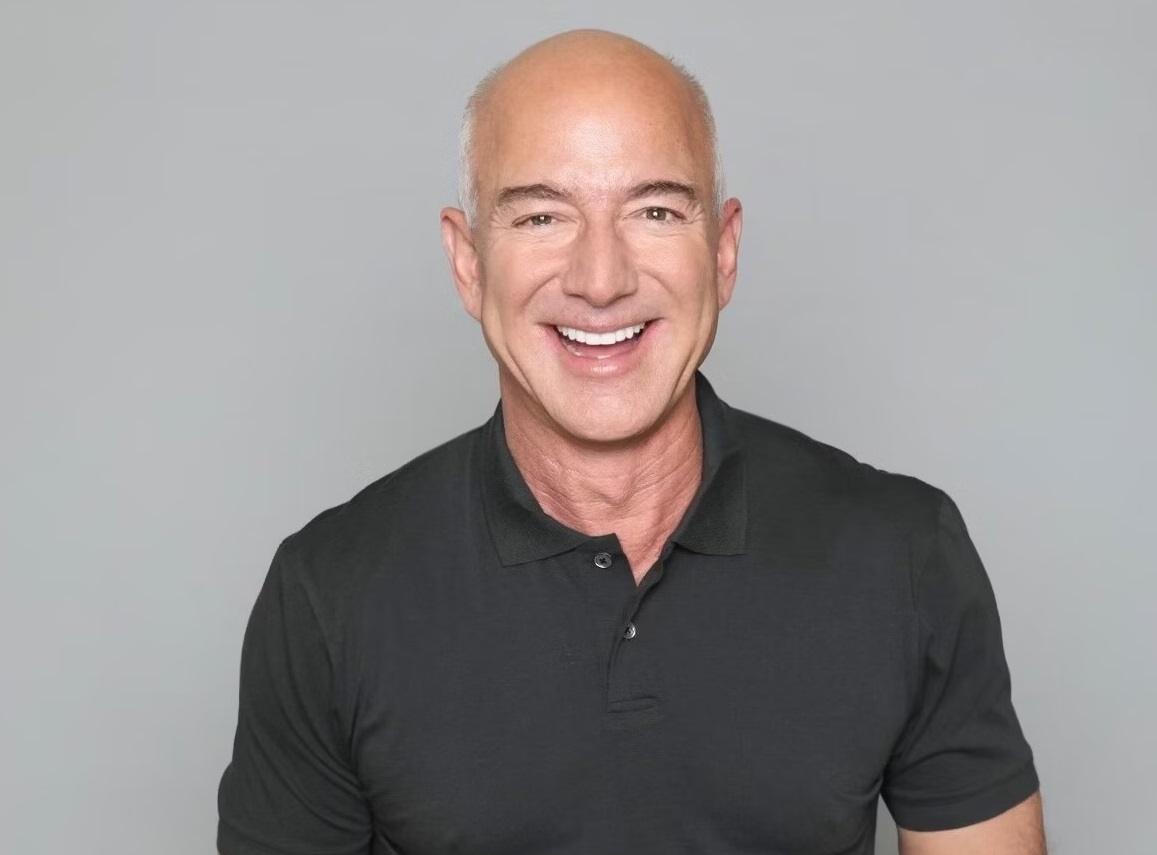

Florent Deixonne, Head of SRI at Lyxor Asset Management, said:

“All portfolios, indices and benchmarks have some form of climate impact. Today, we are beginning the process of helping all kinds of investors assess those impacts and manage those risks by publishing temperatures. There’s little doubt that ensuring investments are truly sustainable becomes a fundamental fiduciary duty for professional investors, whether they are advising institutions or investing on behalf of individuals. Individuals who manage their own money will also be able to use this information to make more climate-aware investment decisions and, should they desire so, better align their portfolios with the temperature goals of the Paris Agreement.”