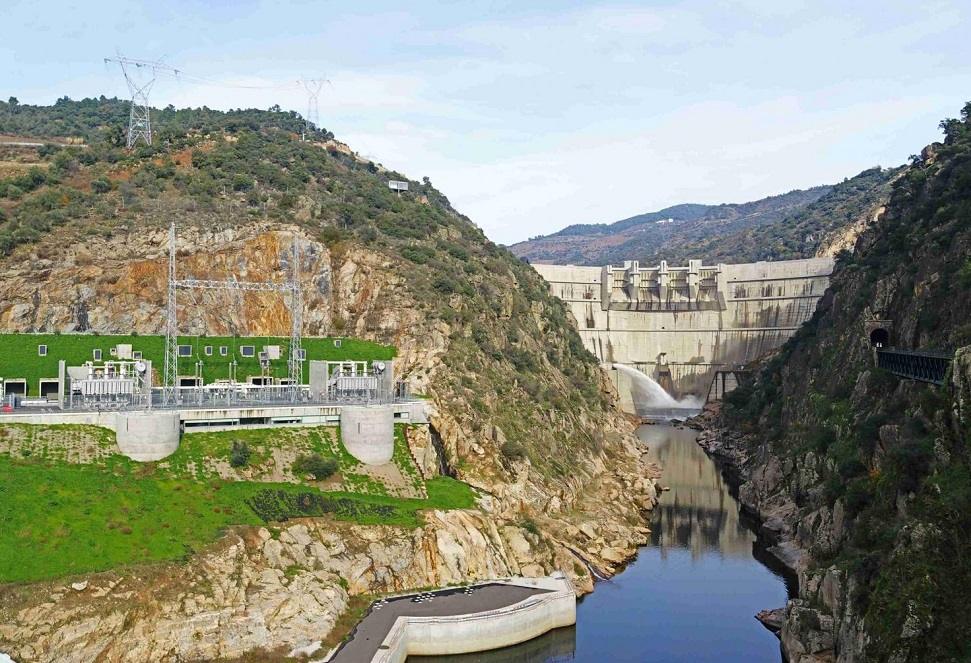

Mirova Creates Co-Investment Vehicle For Investors To Participate in Major Renewable Infrastructure Project

Sustainability-focused investment manager Mirova announced today the launch of a co-investment vehicle, created specifically to enable investors to participate in the acquisition of the second largest hydroelectric portfolio in Portugal, alongside power company Engie and insurance company Credit Agricole Assurances. The portfolio was acquired from EDP for €2.2 billion, with Engie taking a 40% stake, Credit Agricole at 35% and Mirova at 25%.

Mirova stated that the deal highlights a new appetite among institutional investors to be direct investors in large renewable infrastructure projects. Mirova acquired its stake through its Energy Transition fund, Mirova Eurofideme 4 (MEF4), and added investors through the new vehicle including Banca March, Merseyside Pension Fund, Natixis Assurances, Groupama, EB Erneuerbare Energien Fonds Europa and LHI Group.

Raphael Lance, Head of Energy Transition Funds at Mirova, said:

“We have been investing in renewable infrastructure projects for over 18 years now, and only recently have we witnessed this willingness from our investors to commit directly to the projects. For this transaction we had a very strong round of partners from the beginning and were confident that others would join. We are grateful to our co-investors to have given us their trust, a positive endorsement which encourages us to target much larger assets than previously and helping to diversify our portfolio.”