Sharegain Launches ESG Impact Solution for Securities Lending

Securities lending fintech solutions provider Sharegain announced the launch of BetterLend, aimed at enabling clients to make a positive environmental and social impact through securities lending activity.

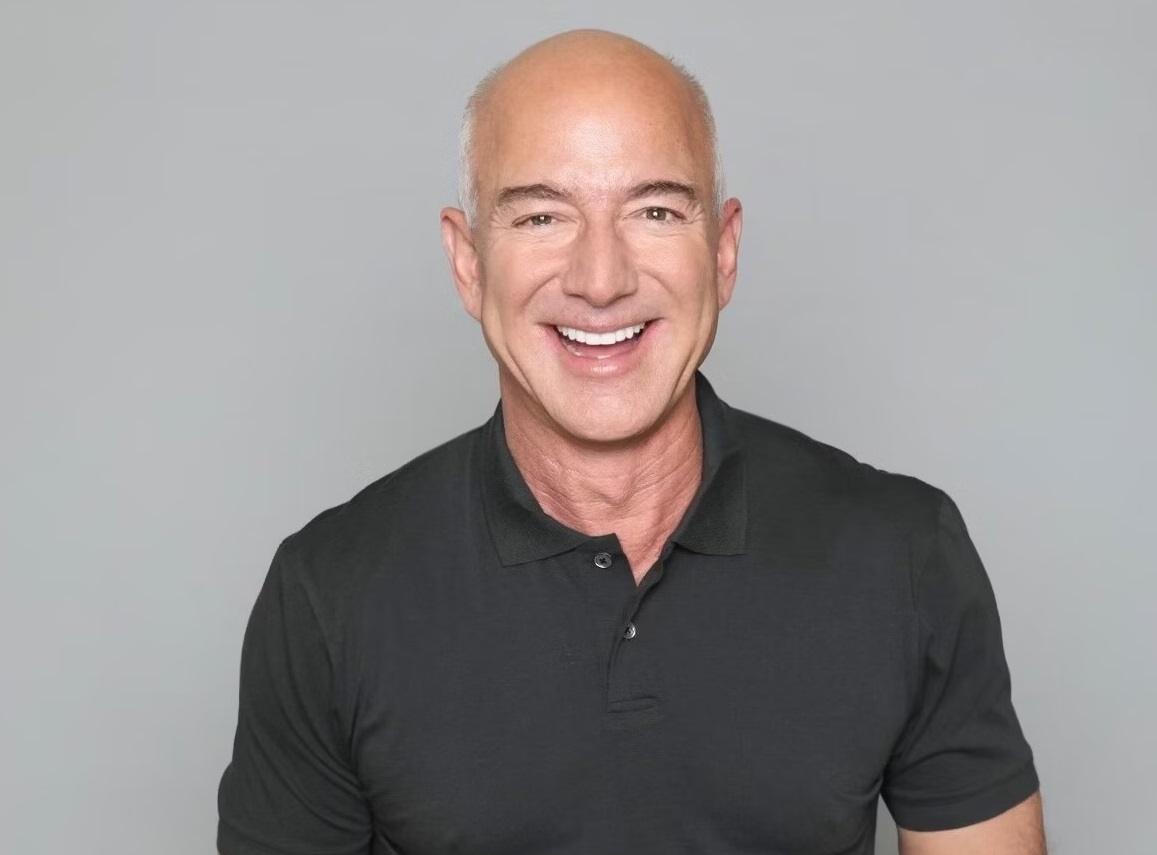

Boaz Yaari, Founder and CEO of Sharegain, said:

“For the first time, a securities lending agent is taking a stand, not just by supporting principles of sustainable finance, but ensuring securities lending revenue is doing good in our world.

“Until now, securities lending has dealt with Governance – the ‘G’ of ESG. So while securities lending might be ESG-compliant, it’s not truly compatible.”

According to Sharegain, clients using the new solution choose the projects they want to support and the impact they want to create. BetterLend allows clients to use their lending activity to create positive change across four focus areas:

- Clean water – funding water projects in developing countries

- Green environment – planting thousands of trees in areas of the world that are most at risk of soil degradation

- Renewable energy – delivering sustainable, low-cost renewable energy to communities where access to energy is expensive, unreliable and unsustainable

- Accessible Education – providing access to education for vulnerable and exploited children currently living in extreme poverty.

The company has partnered with several organizations for the initiative, including charity:water, Tree Aid, Hope for Children, and Renewable World.

Yaari added:

“For the first time, investors are using their lending revenue to make a positive impact in the world. Our clients are planting trees, digging wells and installing solar panels, all by lending their securities.”