Clarity AI, GIST Impact to Launch Biodiversity Impact Assessment and Reporting Solution for Investors

Sustainability technology platform Clarity AI announced today a new partnership with impact data and analytics provider GIST Impact to develop an innovative biodiversity impact assessment product for investors

According to the companies, the collaboration comes amid rapid growth in biodiversity-themed funds, amassing nearly $1 billion in assets this year, and as awareness of the importance of managing biodiversity risks in the financial sector increases.

Pavan Sukhdev, Founder and CEO, GIST Impact, said:

“The imperative for investors to account for biodiversity impacts in their decision-making has never been greater. We’re excited to partner with Clarity AI, combining their deep technology expertise with our industry-leading biodiversity impact methodology and data. Together we’re providing access to credible biodiversity data that is company-specific, geographically accurate, and provides the most holistic coverage of biodiversity impact drivers. This data is critical for effective risk management, and to support action to curb further nature loss.”

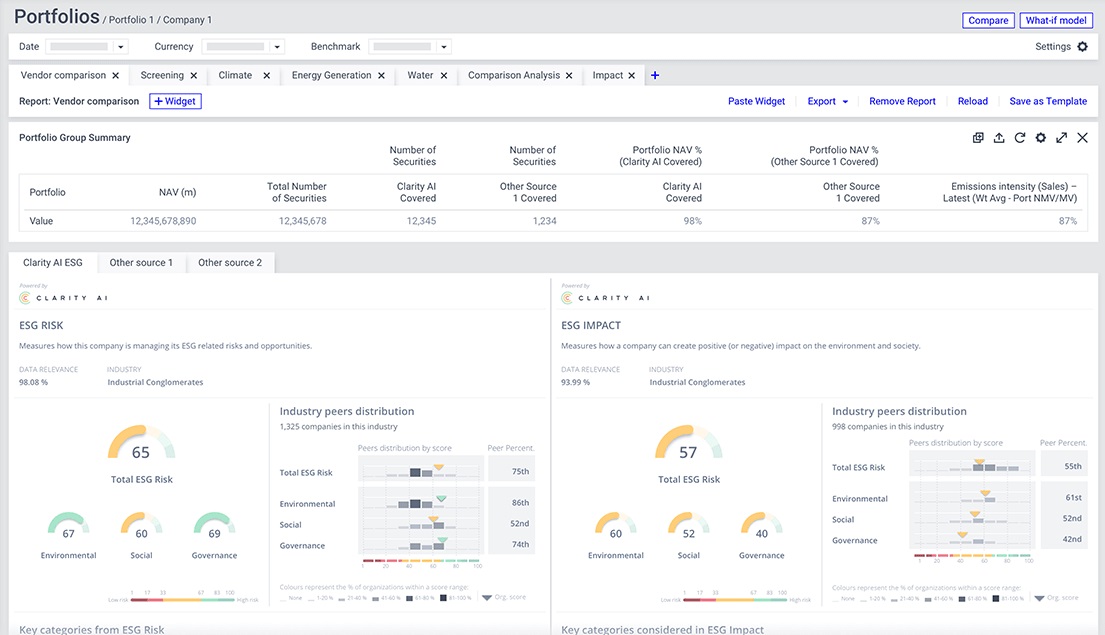

The developed solution will let clients make informed investment decisions by enabling them to measure and size their exposure to companies that negatively impact biodiversity. Combining Clarity AI’s coverage and product ecosystem and GIST Impact’s expertise in biodiversity and impact metrics, it will also take into account the most up-to-date regulatory requirements that could impact investors, including the Sustainable Finance Disclosure Regulation (SFDR) and the Taskforce on Nature-related Financial Disclosures (TNFD).

Angel Agudo, VP of Product and Board Director at Clarity AI, said:

“Partnering with GIST Impact is a significant step for Clarity AI as it enables us to leverage their extensive experience, knowledge, platforms and data on biodiversity impact assessments. Through this partnership, we can provide our clients with the most accurate and up-to-date information on biodiversity risks, allowing them to make informed investment decisions and engage with companies in a meaningful way.”